To make consistent profits on the markets, every trader needs what we call an ‘edge’. This gives you a higher probability of making profit on your specific trade.

Every trader has a different strategy that they use and the more experienced you become as a trader, you will be able to find the best strategy out there for your personality and risk profile.

Our Momentum Trading Strategy has evolved over the years and has become a reliable way to trade, especially for traders who are new to the markets. It is very simple and easy to follow and is a great place to start.

Before we get going, I must just mention that NO STRATEGY WORKS EVERY TIME! You will have some losses and this is an aspect of trading that you need to get used to from the beginning.

All a strategy does is give you an ‘edge’ in the market that, when applied correctly, gives you a better chance at ending the trade in a profit than you would have had if you had just flipped a coin.

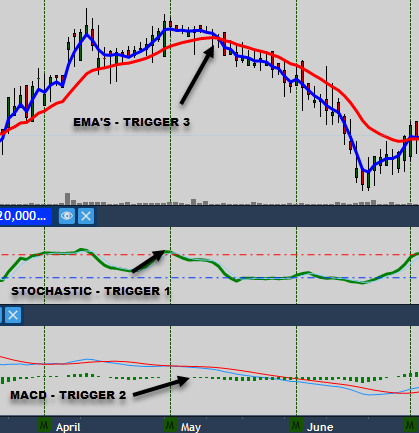

So, let’s get into it. The Momentum Strategy makes use of the three indicators that we spoke about in our previous lesson – the EMA, the stochastic and the MACD.

Although this strategy has the potential to work on any time frame, I feel that when just starting out, it’s a good idea to trade end of day as it allows you more time to think before placing your orders. The shorter the time frame, the quicker you need to make decisions – and the more stressful it becomes. Avoiding stress is very important when first starting out. So, in all of the examples we will be using 1 Day candle timeframes.

Let’s start by looking at each indicator individually and explain what the triggers are to entering a trade. Firstly the Exponential Moving Average. For this strategy we add two EMA’s of different values to the chart. The 3 EMA (fast) and the 15 EMA (slow). The idea is that when these two lines cross, that is a signal that it might be ready for a trade.

LONG TRIGGER: When the fast EMA crosses the slow EMA in an upward direction.

SHORT TRIGGER: When the fast EMA crosses the slow EMA in a downward direction.

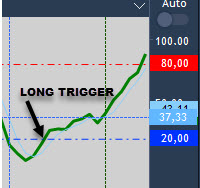

Moving on to the Stochastic Indicator. When the stochastic is high, the ‘bulls’ are in control. When the stochastic is low, the ‘bears’ are in control. So naturally, if the stochastic moves from one state to another, it could signal a change in the direction of the price, hence a trigger for a trade.

LONG TRIGGER: When the stochastic turns up from below to above the 20 level.

SHORT TRIGGER: When the stochastic turns down from above to below the 80 level.

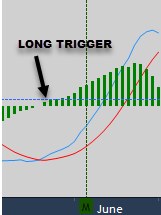

Lastly, we have the MACD. Similarly to the stochastic, the MACD oscillates between ‘bullish’ and ‘bearish’ signals. It’s when these changes occur that a long or short trigger happens.

LONG TRIGGER: When the MACD line crosses the signal line in an upward direction and the histogram goes into the positive.

SHORT TRIGGER: When the MACD line crosses the signal line in a downward direction and the histogram goes into the negative.

Putting it all together:

Now that you know the three triggers, we can put it all together to find some entry points into the market. Remember, none of these are reliable triggers on their own, but when all three are giving signals at the same time you can safely enter a trade, knowing that you have an edge in the market.

Typically the stochastic triggers first, followed by the MACD and then the crossing of the EMA’s but they can technically trigger in any order.

This is what it looks like on a chart when all of the triggers align for a long position.

As you can see from the above example, if you had entered into this trade you could have potentially made a nice profit. Similarly, the triggers for a short position would look like this:

As with the long position, you would have also made a profit on this short position had you entered when all of the indicators triggered and exited correctly.

So, there you have it. That is how you use the Momentum Trading Strategy to identify entry points in the market.

A word of warning: No strategy will be successful unless you have strict money management practises in place. Always decide beforehand how much you are willing to lose on any particular trade and place a stop loss order accordingly. Deciding when to take profit can also be a tricky decision as you don’t want to be too greedy but, at the same time, you don’t want to exit before realizing your potential profits. We will go through fear and greed in our lesson on Trading Psychology!

Please contact us if you are unclear on any of the aspects of this strategy. We are here to help!