When trying to establish what the fees are for the trading you want to do, finding the correct information can often be quite challenging.

You can find all the information on fees for all instruments on our trade desk at http://suretrading.tradedesk.co

This website can also be quite confusing. Hopefully my explanation below will shed some light on how the trading costs work.

On the trading platform, find the instrument in your watchlist (I will do an example using the commodity Gold XAU)

1. Highlight the row by clicking once on the name. (Double clicking will open an Order Entry window)

2. Right click on the instrument, and then in the menu that appears click on ‘Symbol Info’.

In the Symbol Info window, scroll down until you see the Margin Requirements and Fees for this instrument.

3. Margin Requirement: The margin requirement is the amount of money you need to have in your trading account to be able to execute the trade. As you are trading a CFD, which is a leveraged product, this margin requirement is the ‘deposit’ you are required to put down when you execute the trade. Like when you buy a car on instalments, you first put down a deposit of a certain percentage of the total cost before you can benefit from the use of the car. Your deposit only pays for the four tyres and the steering wheel, but once you have filled in the paperwork, you can drive the whole car out of the showroom. You pay interest on the loan every month until fully paid.

Very similar when trading on leverage. You put down a deposit towards the trade, and then, if you keep the trade open for more than one trading session, you will pay interest on the money you loaned.

As an example, Gold XAU, has a margin requirement of 2%. This is 2% of the price of the instrument (Position Exposure).

Highlighted in yellow above is an open position on Gold.

1 Gold Contract @ USD1755.64 (Open Price) X R16.79 (Current USDZAR) = R29 486.71 (Position Exposure).

Position Exposure in this case is the cost of 1 Gold contract at the time of purchase (Open Price). This amount stays static for the duration of the trade.

Position Value is the Position Exposure price, plus or minus the difference between the Open Price and Current Price. This amount fluctuates while the position is open.

The Margin Requirement (which does not reflect in the Open Positions menu)in this caseis 2% of the position exposure. 2% of R29 486.71 = R589.49. When you are trading a derivative (CFD), you only pay a deposit towards the trade (R589.49 per contract).

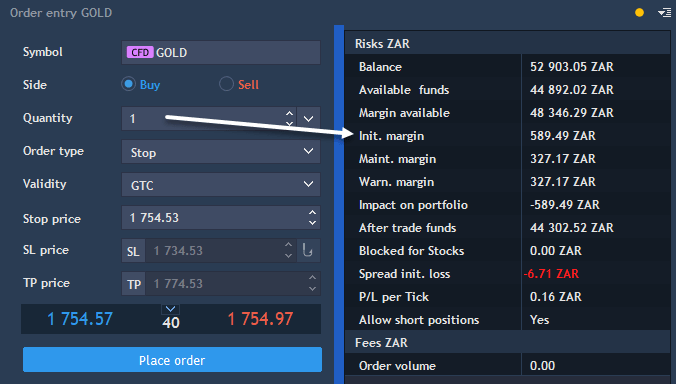

This Initial Margin reflects in the Order Entry window below. (When opening an Order Entry, make sure to click on the light blue line on right-hand border to further open the menu)

Trading a derivative product (CFD) essentially means that you are trading with borrowed money. Another way of saying it is that you are trading on margin. We all know that there is always a cost involved when borrowing money, called interest. In the trading world, this interest charge is called Swaps. The liquidity provider, in our case Nedbank, is lending you money to trade with. When you place a trade in the market, the liquidity provider has to pay the full price for the instrument. So, in this case, Nedbank purchases Gold futures from the market to the value of R29 486.71, meanwhile you have only deposited R589.74 towards the trade.

In the symbol info window above, you will see the interest charged for Long Swap is 6.19% pa and the Short Swap is 1.23% pa.

Here is how the calculation is made: Position Exposure R29 486.71 X 6.19% pa = R1 825.23 pa. This is what it will cost you to keep this position open for 12 months. Of course you don’t know up front how long you are going to keep this position open, so what they do is divide this yearly amount by 365 days, and charge you a small amount on a daily basis. This works out to R1 825.23/365 = R4.99 per day. So, if you keep the position open for 7 days, the cost will be R4.99 X 7 days = R34.93 for the money borrowed towards the trade. This is a daily charge for the duration of your open position, and includes weekends.

You will notice that there are no fees reflected when you are trading derivatives (Commodities CFDs, Indices CFDs, Forex CFDs, Crypto CFDs). The broker slightly widens the spread between the Bid and Ask prices of the instrument, which is the reason why, when entering a position, it immediately reflects a small loss, called Spread Initial Loss (see Order Entry screenshot above).

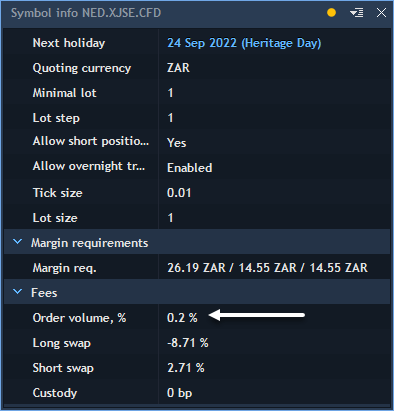

Equity CFDs carry a Broker Fee, of 0.2 % of the Position Exposure, with a minimum of R50 when you enter, and again when you exit the position. (Order Volume – under Fees ZAR in the Order Entry Window above)

Nedbank example below:

Nedbank Position Exposure is R17 251.20 (80 CFD contracts X Open Price R215.64 = R17 251.20)

Broker costs R17 251.20 X 0.2% = R34.50. You will see that it reflects a fee of R50.00. This means if your Position Exposure on a position is less than R25 000, the transaction costs will be a little more than 0.2%. The smaller your equity CFD position, the more the share has to go in your favour before you show a profit.

Notice the swaps on local equity CFDs. If you are long, you will pay swap. If you are short, you will be paid swaps.

Notice also that with equity CFDs the margin requirement is not reflected as a percentage, but as a ZAR figure per contract.

The calculation for Swaps is the same: R17 251.20 X 8.71% = R1 502.58/365 = R4.12 per day.

I trust this helps. It would be appreciated if you could let me know if there is anything not clear, so that I can clarify it for you.

Ross Larter